Financial Modelling in Excel Course

A practical approach to designing scalable, flexible and reusable financial models using Excel. During the webinar series we will create a complete a range of useful Excel models from budgeting, forecasting, FIFO, amortisation schedules, discounted cash flow analysis, what if analysis, project costing, activity based costing, formula tips and tricks and specifically consider:

Building assumptions to generate what if scenarios.

Generating a predictive P&L template in a format which can be easily consolidated.

The models will be interactive to allow for what if analysis during Budget presentation meetings.

The above is a brief overview of the of the financial modelling in Excel Course. It outlines the key issues

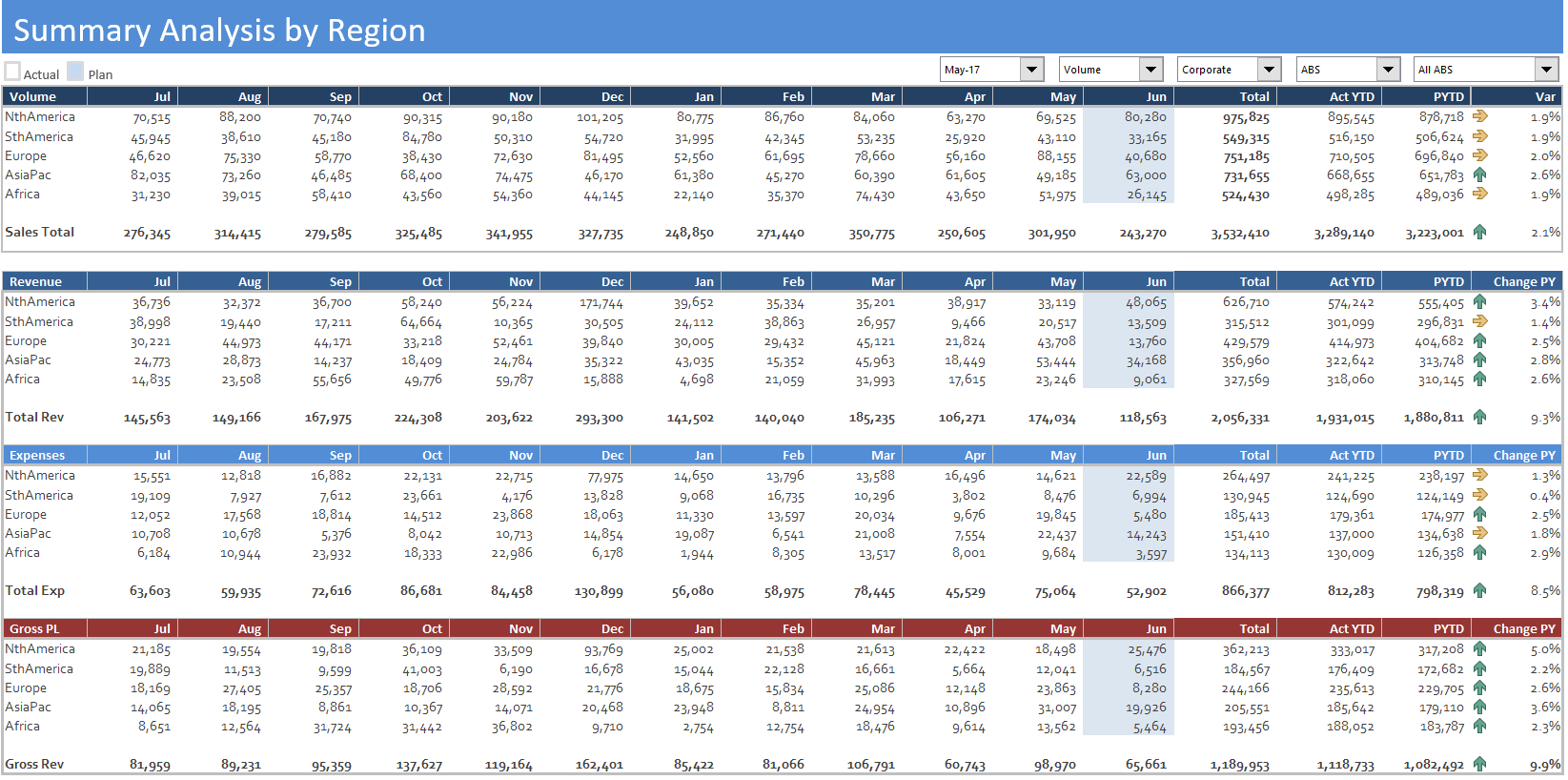

Output from one of the financial modelling tutorials.

The following is a link to the Excel course proper: The course contains the following 12 one hour videos (12+ hours).

Excel Short Cuts

Budgeting in Excel

Advanced Financial Modelling Techniques

Bottom Up Budgeting

Forecasting Development Using Excel

Charting for Trend Analysis

Activity Based Costing in Excel

DCF Modelling in Excel

FIFO Using Excel

What IF Analysis Using Excel

Essential Formulas in Excel

Project Costing Model in Excel

All videos come with an Excel start workbook to follow along with.